- Mareike Deggelmann

- 26.01.26

- 3 min

- Funding advice, Agrifood, Bioeconomy

Your contact person

Tobias Kübler

The funding landscape in Germany is diverse, with various programmes and correspondingly different guidelines. These programmes are designed for research and development projects (R&D), as well as for investment measures

Innovations usually mean considerable opportunities, such as new sales markets and differentiation from competitors. However, the road to the finished product normally takes a while. There are many technical hurdles that companies must overcome before reaching market success. There are also many business uncertainties, such as market development, the competitors’ products and so on. For companies to tackle innovation despite these hurdles, funding programs exist. This is intended to mitigate the risk for the companies.

But not every funding programme is suitable or available to every company. Many of the funding programmes are aimed at SMEs, which stands for small and medium-sized enterprises. It means that the company must have <250 employees and either <€50m in turnover or <€43m in total assets. If it does not meet these requirements, it is considered a large enterprise. Please note: these key figures do not only define the company itself, but also ownership and shares.

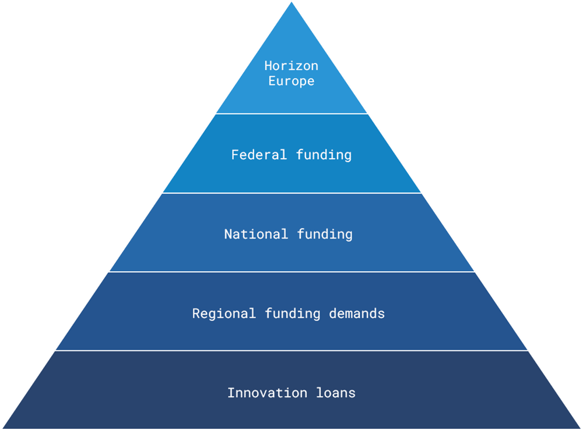

The funding pyramid provides a clear overview of the funding landscape in Germany.

The lowest level is represented by innovation loans or promotional loans. These loans can be granted by Landesbanken or KfW. Innovation loans are characterised by reduced interest rates and repayment subsidies. They represent the basis because they are not granted through a competitive process. If the company meets the requirements, it receives an innovation loan.

Regional funding programmes are rare in Germany, and when they are introduced, they are usually only aimed at SMEs. The biggest diversity of programmes is offered by state and federal funding.

Some of these funding programs are easy to plan for, as the funding guidelines apply for several years and applications can be submitted permanently, or by fixed deadlines. In some cases, the project can be started as soon as the application is submitted, at the applicant's own risk. The programs that are difficult to plan are funding calls. They are strictly field-focused and normally consist of two application stages. This means that a project’s proposal must be submitted to the project management agency by a certain deadline and the project management agencies/ministries select the best projects from the received proposals. The selected companies are then allowed to apply. In the case of funding calls, the project partners are usually not allowed to start the project until they receive the funding decision so six months or more may pass between the proposal submission and the start of the project.

Another interesting aspect of project funding is that in most projects collaborations are encouraged and supported. A company can form a consortium with other companies and/or research institutions. Cooperation synergies facilitate knowledge and skill exchange within a project. In most cases, the research institutions receive 100% funding, so that the company does not sustain any direct expenses from the collaboration.

In the case of EU R&D programmes, the whole thing becomes even more complex, since here usually three institutions from three different countries have to be project partners. Often the project consortium is much larger and, therefore, more difficult to manage.

An important point to keep in mind about the above funding opportunities is that you must apply before they start. One exception in the funding landscape is the “Steuerliche Forschungszulage” programme. In this case, companies can submit applications for research and development projects retroactively if the programmes haven’t been started before 01.01.2020.

A company looking for the right funding programme must answer the following questions:

Tip: Why not take advantage of EurA's free funding check?

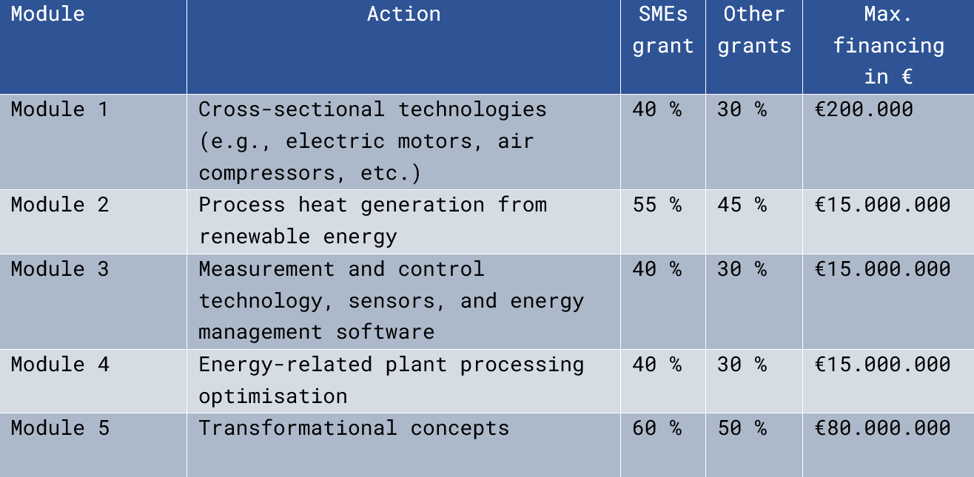

Investment support is similar to R&D support. There are also various funding pots from the federal and state governments. Most investment support programmes are related to the creation of new jobs, and energy and resource efficiency measures. The below table shows as an example the federal programme for energy and resource efficiency:

There are many other points to consider when it comes to investment support (e.g., how much CO2 is saved, how high are the additional investment costs, etc).

When applying for investment support, it is also important that before tenders are distributed, the application must be submitted and, in most cases, already approved.

Find out more about our funding advice here.

Our team of experts will gladly assist you in the development of the funding project, the application process and project dissemination. Get in touch!

Text: Tobias Kübler

Your contact person

Tobias Kübler

EurA AG

T- 079619256-0Max-Eyth-Straße 2

73479 Ellwangen

info@eura-ag.com