- Mareike Deggelmann

- 26.01.26

- 3 min

- Funding advice, Agrifood, Bioeconomy

Your contact person

Benjamin Raab

Handing over a company, selling it in whole or in part, or even merging companies requires tact and experience. Especially in medium-sized businesses, many companies have a life's work behind them. We help you to master this challenge. This includes not only deciding on the right model and the right candidate or candidates, but also suitable solutions for experience sharing and financing.

The success of owner-managed companies can have many causes. The commitment to uphold traditions without losing sight of innovations, to maintain proven virtues and at the same time to remain open to the upcoming challenges while changing framework conditions are elementary building blocks of a long-term corporate strategy. Company succession plays an important role here, and is one of the defining moments of a family business. After all, it is a matter of filling the key position in a business for the long term. The implications for the business and the employees are enormous. Succession in family businesses is also very important for the German economy. Particularly in the SME sector, many companies have a life's work behind them.

Many of the major family businesses in Germany have successfully carried out at least one corporate succession. They know that the task is most likely to succeed if the family and the company deal with succession planning at an early stage. After all, it is the family members involved in the ownership and, if applicable, the management of the company who make decisions that ultimately shape the company and its behavior.

There is certainly no ideal time for a generation change. The goals, framework conditions, interests and financial and human resources of those facing such issues as the steerers of companies are too different. However, drawing attention to the attitudes, values and future plans of the next generation seems to make absolute sense against the background of the long-term nature of family businesses.

The key to success lies in early and serious planning for the economically successful transition of businesses to the successor generation. Above all, however, the associated task of maintaining a created corporate culture requires careful consideration of this issue as well as competent succession consulting.

Without appropriate preparation and a structured succession process, problems can arise that are not compatible with the owner's ideas on such important issues for ensuring competitiveness. Often associated with this is also the concern of a sustainable retirement pension to ensure prosperity. On the other hand, there are equally significant issues for business successors after the handover, as experience reports clearly show, because the need for investment or restructuring is underestimated in many cases. For some years now, it has been observed that the gap between senior entrepreneurs and suitable succession candidates is widening and that there are fewer people interested in taking over a company because the attractiveness of switching to an employee relationship is increasing because of the shortage of skilled workers and corresponding job offers. The declining rating of companies following the end of the pandemic and the geopolitical changes in Europe are also increasing financing risks, which may deter some from taking on entrepreneurial responsibility.

Between the years 2022 and 2026, about 190,000 companies will face a handover, about 38,000 annually, because owners will leave management due to age, illness, or death, estimates the Institut für Mittelstandsforschung (IfM Bonn). Almost half of the handovers take place in the business-related services sector, and more than a quarter in the manufacturing sector and in companies with annual sales of 500,000 to 1 million euros. This is why it is so important now as a far-sighted entrepreneur to deal with this issue at an early stage.

Our experts attach great importance to tailor-made solutions and concepts within which the individual preferences for company succession can be optimally considered. Experience has shown that this includes not only cooperation with the company's tax advisors, but also consideration of special aspects of corporate law, inheritance law and family law. An elementary prerequisite for the success of the transfer of assets is early and active succession planning and the support of experts. You need to make provisions not only for the foreseeable event of an age-related "exit", but also in particular for emergencies.

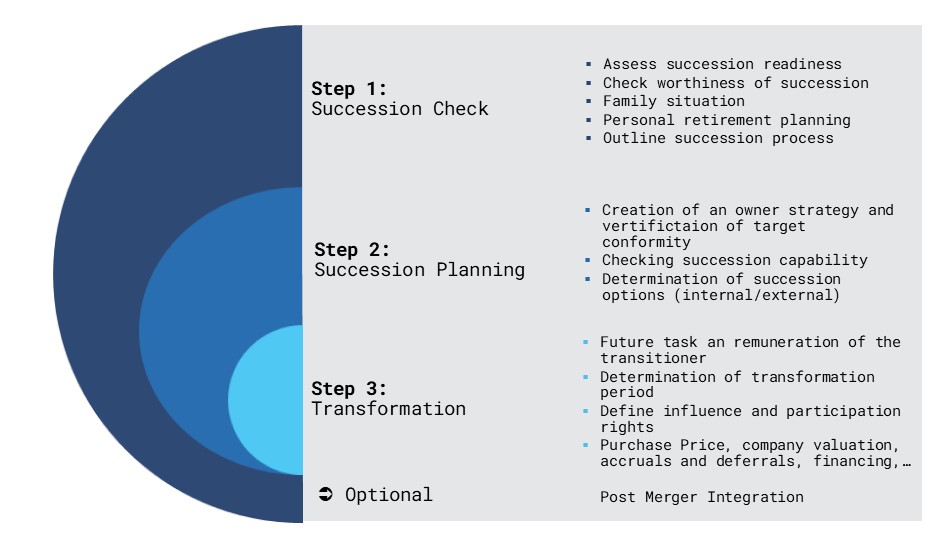

We see ourselves as specialists who, with competence, practical experience, and a great deal of intuition, help you to design tailor-made processes for the generation change. In a workshop, we conduct a succession check with you and provide you with initial recommendations for action. After that, the actual work of succession planning begins, in which we present you with succession options, considering your goals and ideas, in order to be able to start the transformation after prioritization. It is not uncommon for such processes to take a period of up to 18 months after completion of the first step - the succession check. There are no patent remedies, every company and situation are different. For sustainable succession planning and successful implementation, we recommend a half-day work store to define expectations and goals as the basis for an action plan to be developed.

EurA Venture GmbH – a subsidiary of EurA AG – is your partner in all questions of corporate financing, partner search and corporate succession. We have been active as consultants in Germany and abroad for more than 25 years. Our cross-sector spectrum ranges from larger craft enterprises to SMEs. We advise not only sellers during the transformation process, but also managers looking for entrepreneurial responsibility.

Text: Uwe Herrgott

Your contact person

Benjamin Raab

EurA AG

T- 079619256-0Max-Eyth-Straße 2

73479 Ellwangen

info@eura-ag.com